Housing Market 2017 When Will Housing Prices Drop Again

I've noticed a trend lately. Everyone's a existent estate expert.

It seems the well-nigh contempo crunch and recovery has turned only about every unmarried person into a guru on all things to do with dwelling house ownership and selling.

I suppose part of it has to practise with the fact that the massive housing bubble that formed a decade agone swept the nation and was front page news.

It also directly affected millions of Americans, many who serially refinanced their mortgages, then constitute themselves underwater, and then somewhen brusque sold, were foreclosed upon, or held on for the ride back up to new heights.

And now with home prices surging and real manor and then expensive, information technology might be conjuring up not-and so-afar memories for some that we could be in for some other rude enkindling.

A New Housing Chimera Mentality

- Real estate is red-hot again thanks to limited supply and intense demand

- It tin feel similar an ominous sign that we're headed down a dark road again

- Merely that alone isn't reason enough for the housing market to crash again

- There have to be clear catalysts and financial stress for another major downturn

It'due south a mutual conversation piece these days to talk near your local housing market.

Thank you to greater access to data, folks are scouring Redfin and Zillow and coming up with theories virtually what that home should sell for, or what they should have listed information technology for.

Neighbors are getting upset when nearby listings are not to their liking for one reason or some other. What were they thinking?!

Others might captivate over their Zestimate or Redfin Guess, every bit if it's a stock ticker, constantly refreshing information technology day later day in the hope it has moved higher.

All of this chatter portends some kind of new chimera mentality, though it seems everyone is but basing their hypotheses on the nigh recent housing bust, instead of perhaps considering a longer timeline.

One could await at the recent run-upwardly in home prices every bit yet another bubble, less than a decade since home prices bottomed around 2012.

Later on all, many housing markets have at present surged well beyond their previous lofty levels seen about 15 years agone when abode prices peaked.

For example, Denver surface area home prices are about 86% higher than they were in 2006. And dorsum then, everyone felt home prices were completely out of control.

In other words, dwelling prices were haywire, and are now almost double that.

Meanwhile, the typical U.S. home is currently valued around $273,000, per Zillow, which is nearly 27% higher than the top of $215,000 seen in early 2007.

Information technology's besides nearly 70% college than the typical home price of $162,000 back in early on 2012, when home prices more or less bottomed.

So if want to look at dwelling house prices lonely, you could offset to worry (though you likewise have to factor in inflation which will naturally raise prices over time).

They Say Bubbling Are Financially Driven

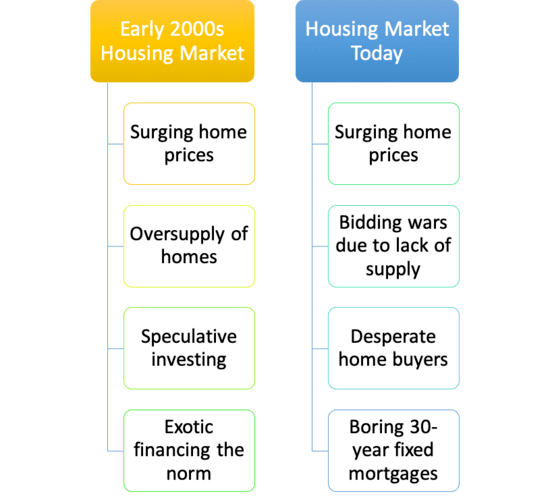

While surging home price appreciation tin certainly give u.s. all pause, that alone may not be a problem. Well, at least in terms of an impending crash.

They say bubbles are financially driven, and we've however to see a render to shoddy underwriting.

I volition say in that location'southward been a lot of near-nil downward financing, with many lenders taking Fannie and Freddie's 97% LTV plan a pace further by throwing a grant on acme of information technology.

This means borrowers can purchase homes today with just 1% down payment, and even that tiny contribution can be gifted from someone else.

So things might be getting a fiddling murky, particularly if y'all consider the large increase in prices over the past four or five years.

Still, most new habitation buyers need larger down payments to "win" homes these days when in that location are multiple bidders.

I could also argue that affordability is being supported past artificially low mortgage rates, which history tells us won't be around forever.

There's too a full general sense of greed in the air, along with a feeling among homeowners that they're getting richer and richer by the day. And that it won't let up.

That type of attitude sometimes breeds complacency and unnecessary adventure-taking, and trouble usually follows.

But When Will Home Prices Crash Once more?!

- If you believe in cycles, which seem to exist pretty axiomatic in existent manor and elsewhere

- Nosotros will see another housing crash at some betoken relatively soon

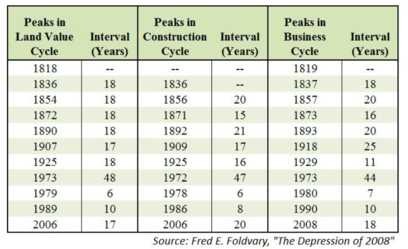

- There appears to exist an xviii-year cycle that has been observed for the by 200 years

- This means the adjacent dwelling house toll peak (then bust) might begin in 2024

All of those recent abode price gains might make one wonder when the next housing marketplace crash will take identify.

After all, home prices can merely go up for and so long before they drop again, right? Well, the answer to that age-old question might not exist as elusive as you retrieve.

The real estate market apparently moves in cycles that some economists think can be predicted to a relatively high degree.

While not a perfect science, at that place seems to exist "a steady 18-year rhythm" that has been observed since around the year 1800.

Yep, for over 200 years nosotros've seen the real estate market follow a familiar nail and bust path, and at that place'due south really no reason to think that will stop now.

Information technology puts the next home price top effectually the year 2024, followed by perhaps a recession in 2026 and a march down from there.

How much domicile prices volition fall is an entirely dissimilar question, just given how much they've risen (and can rise still), information technology could exist a long, long mode downwards.

And we might non have super low mortgage rates at our disposal to save u.s. this time, which is a scary thought.

You'll Never Get Back Into the Housing Marketplace…

- At that place are four main phases in a real estate cycle

- A recovery period and an expansion period

- Followed past hypersupply and an eventual downturn

- Don't believe the hype that if you don't buy today, yous'll never go the adventure!

Another housing bust in inevitable, despite folks telling the states we'll never go back in over again if we sell our home today, or don't buy i tomorrow.

There are four phases to this predictable cycle, including a recovery phase, which we've clearly experienced, followed by an expansion phase, where new inventory is created to satisfy demand. This is happening now.

At the moment, home builders are ratcheting up supply to encounter the intense demand in the market place, with some 45 million expected to hitting the average starting time-time home buyer age this decade.

The problem is like annihilation else in life, when demand is hot, producers take a tendency to overdo information technology, creating more supply than is necessary.

That brings us to the side by side phase, a hypersupply period where builders overshoot the mark and air current up with too much new construction, at which point prices collapse and a recession sets in.

The skillful news (for existing homeowners) is that according to this theory, we won't meet another dwelling price peak until effectually 2024.

That ways some other three years of appreciation, give or take, or at to the lowest degree no major losses for the existent manor market equally a whole.

So even if you purchased a habitation recently and spent more than y'all would take liked, it could very well expect cheap relative to prices a few years downwardly the line.

The bad news is that the real estate market is destined to stall again in just iii short years, meaning the upside is going to diminish quite a scrap over the next few years.

This might be especially true in some markets that are already priced a little bit ahead of themselves, which may exist running out of room to go much higher.

Only mayhap more important is the fact that domicile prices tend to move higher and higher over time, even if they practice experience temporary booms and busts.

Then if y'all don't attempt to time the market you can profit handsomely over the long term, assuming you lot tin afford the underlying mortgage.

And remember, in that location's more to homeownership than simply the investment.

Source: https://www.thetruthaboutmortgage.com/when-will-the-next-housing-market-crash-take-place/

0 Response to "Housing Market 2017 When Will Housing Prices Drop Again"

Post a Comment